UPDATED June 13, 2025 with credit given to Caesar Sedek who has written an extremely detailed article on the same topic on his website Caesar the Day.

There is much to consider when looking at uprooting and moving to a foreign country by choice. As I have researched earnestly into the implications of making a move to Italy, a dream my wife and I have held since we first fell in love with the country almost 20 years ago, I’ve uncovered some hard realities. Deal killers? Maybe, maybe not – there is a lot to consider, though.

7% Flat Tax Regime

Italy has a 7% Flat Tax Regime. It is a tax incentive for retirees who move to certain regions of Italy, almost all exclusively in southern Italy or designated high-risk earthquake zones .

The retiree must be a resident in a town with fewer than 20,000 inhabitants. The flat tax plan has a duration of ten years and cannot be renewed.

Tax Residency & Foreign Tax Credit

Like many other countries, if you live in Italy over 183 days in one year, you become a “tax resident” and are subject to Italian tax law. This gives Italy the right to potentially tax you on all income you receive from anywhere in the world.

There is a tax treaty between the U.S. and Italy. This treaty specifies which country (Italy or U.S.) can tax specific types of income. Social security income would only be taxed in the U.S. However, income from retirement plan (ex. 401K, IRA, SEP) distrubtions would only be taxed in Italy.

Other income, such as investment income from non-retirement plan accounts, would be taxed first in Italy and then potentially then the U.S. However, the tax treaty usually prevents double taxation by allowing a “foreign tax credit” for taxes already paid to Italy.

Essentially this means that if a retiree takes up Italian residence in a 7% flat tax zone, the benefit would be that any income that is taxed by Italy would be taxed a flat 7% rate and the IVAFE tax would be waived. So distributions from a recognized retirement plan (ex. 401K, IRA, SEP) would be taxed at 7%. This is a huge savings from the normal Italian progress tax rate schedule.

Social security income is taxed by the U.S. per the tax treaty. So the 7% flat tax would not be applicable since it would be taxed by the U.S. at the normal U.S. tax rate percentage.

Other income (ex. interest, dividents, capital gains) that are outside of recognized retirement account (ex. 401K, IRA, SEP) would be taxed at the 7% flat tax. But this type of income would also be taxed in the U.S. However, to prevent double taxation, that tax treaty specifies that a “foreign tax credit” can be taken for the amount of taxed paid in Italy. So this other income would then be effectively taxed at the normal U.S. tax rate percentage when the taxes paid to both countries were added together.

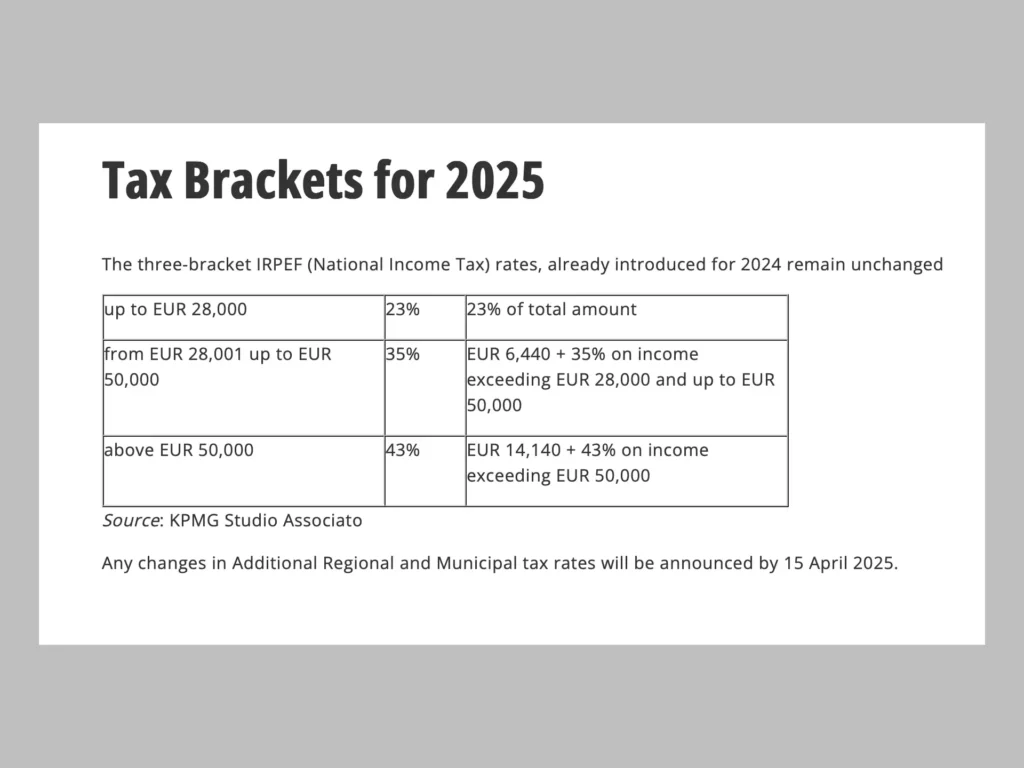

Italian Income Tax Rates

If a retiree does not move to a 7% Flat Tax location in Italy, their income tax liability would be substantially higher in the U.S. In 2025, Italy has three income tax rates:

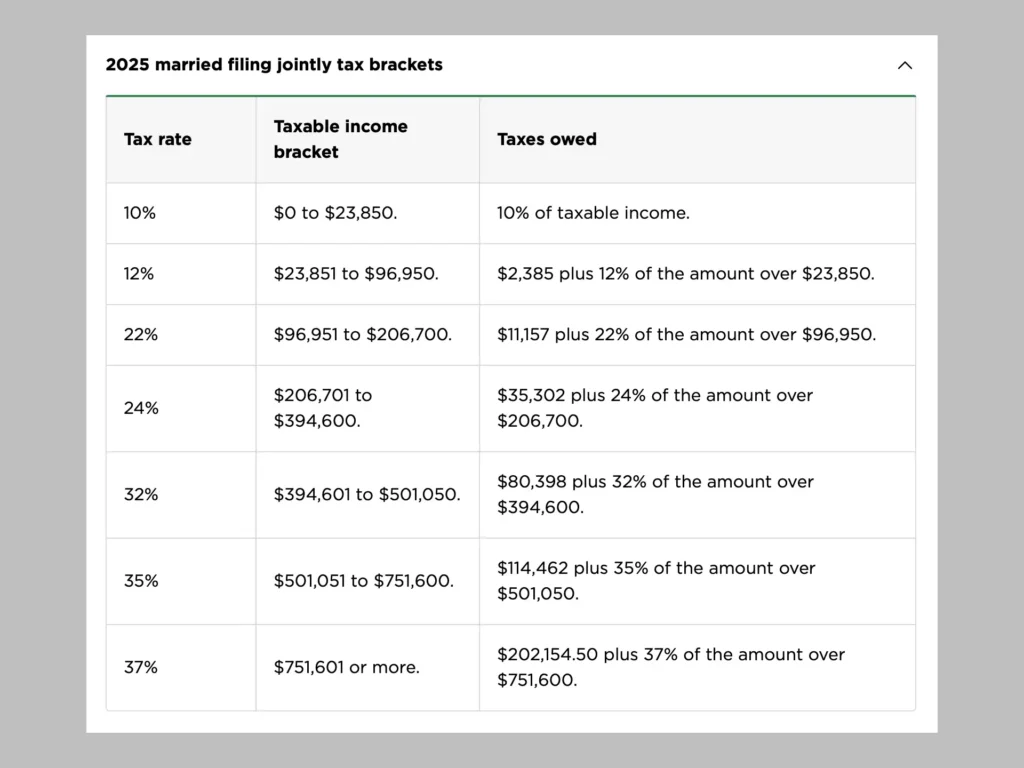

U.S. Income Tax Rates

The corresponding 2025 income tax rates in the U.S. for married filing jointly are:

Income Tax Differences Between U.S. and Italy

Some general differences between Italy and the U.S. are that there are substantially fewer potential deductions in Italy. In the U.S., there is a standard deduction of $33,000 for a married couple which subsequently makes the taxable income substantially lower. In the U.S., state income tax varies greatly; eight states (ex. Texas) have zero state income tax while California has a progressive state income tax that reaches over 13%. In Italy, the regional tax rate is 1.23 to 3.33% with an additional municipal income tax of 0 to 0.9%. Italy requires each person to file their own individual income tax return. Italy also has a 0.2% IVAFE tax that is applicable to the value of any bank or investment account in the world, but does suspend this tax under the 7% flat tax plan.

How Much of a Benefit is the 7% Flat Tax Plan?

If a retiree moves to Italy under the ERV to an area that does not fall under the 7% flat tax plan, they will become an Italian tax resident after 183 days. For most couples, their total income tax liability will increase approximately 2 to 3 times the tax amount they would have been paying as a U.S. tax resident.

If the couple moved to a 7% flat tax area, their taxes would be approximately the same or slightly lower in comparison to being a U.S. tax resident. The reason the total taxes might be lower is because recognized retirment plan distributions would be only taxed by Italy at the 7% rate. However, this benefit would cease to apply after ten years and distributions would then be taxed at the substanially higher progressive Italian income tax rates, eventially offsetting the lower taxes for the ten year period of time.

In discussions of the tax rates of Italy versus the U.S., there is often mention made of some offsetting factors. Common topics are property taxes and medical expense.

Property Taxes – Italy vs. U.S.

Property tax rates in the U.S. vary by location. States with no state income tax typically have a higher property tax rate. For this analysis, I will use the average Texas property tax rate of 1.8%. If a couple owned a $300,000 home, the annual property tax would be $5,100. For a $600,00 home, the annual property tax would be $10,200.

In Italy, the IMU property tax (0.5 to 1.06%) and it only applies to second homes and luxury residences. So, for the retiree that relocated to Italy, this tax would likely not apply for the home that was their primary residence.

Medical Expenses – Italy vs. U.S.

For the typical retiree in the U.S., Medicare would be applicable. Medicare costs approximately $7,300 a year for a couple that pays for Part B without IRMAA surcharges, a zero cost Part D, and a Medigap G policy. Each person is liable for $257 Part B deductible and a max out of pocket drug expense of $2000 (new 2025 law).

For the retiree in Italy, usually within their first year of arrival, they can join the National Health Service SSN plan that would provide for public care with minimal co-payments for drugs and services. For non-citizens, this requires a payment of EUR 2000 per person. So, the total expenses for a couple in Italy would be approx. EUR 4000.

When comparing the cost savings for medical expenses in Italy versus the U.S., it is approximately EUR 2700 per year. This assumes that the retiree would not be obtaining medical care outside of the Italian public health system.

Other Expenses – Italy vs. U.S.

Groceries are less expensive in Italy, at approximately two-thirds of the cost they would be in the U.S.

While Italy has excellent public transportation, the cost of energy is substantially higher. A liter of gasoline or a kilowatt-hour of electricity is approximately twice as expensive in Italy as in the U.S. Natural gas is slightly more than twice as expensive. This results in substantially higher utility costs unless lifestyle adjustments are made regarding consumption.

In the U.S., the average state and local sales tax is 7.7%. In Italy, the VAT is 22%. In both countries, this tax is reduced or doesn’t apply for certain categories of items or services.

Summary

A retiree moving from the U.S. to Italy will need to plan for and accept that there will be a sizeable increase in their income tax liability. Also, expenses for the higher cost of energy and consumption taxes (VAT) will need to be planned for and budgeted. It is true that a portion of these additional expenses will be partially offset by lower cost of medical care and no property tax for full-time residents.

The Italian 7% tax plan essentially defers the significant increase in income tax liability for ten years. One must be willing to move to a location that qualifies, remain there for ten years, then accept the fact that the tax benefits will cease to apply after ten years. However, the potential tax savings over a ten-year period are substantial. This is especially true for retirees with a higher income level.

Personal Thoughts

As Paula and I continue with “Trying On Italy”, will this information affect our decision to move to Italy? I can say that it has been eye-opening and has given us a bit of pause. It makes us reconsider living there part-time on the Schengen Shuffle approach. If we did decide to move to Italy full-time, we would likely only consider locations that would qualify for the 7% flat tax plan.

Disclaimer

I am not an accountant or contabile. I am not an attorney or avvocato. This spreadsheet analysis uses many assumptions as the potential variables are infinite. My information, assumptions, and calculations could be in error.

My intention is to try to make some generalized assumptions to calculate approximate amounts that would allow a U.S. retiree to be aware of the financial pros and cons of retiring in Italy. Also, to be able to weigh the value of the 7% flat tax plan that Italy offers for making the decision to relocate in a 7% flat tax plan location.

This is fabulous, Marty. Thanks for the information on your thought processes as you make this momentous move . We will miss you, but OF COURSE you have to do this…..

I have dual citizenship-US and Italian. Would I be able to utilize the 7% flat tax for 10 years if I moved to a qualifying town in Southern Italy?

I am not sure this applies to dial citizens. I suggest contacting:

https://www.caesartheday.com/

He has put together an amazing website far more detailed than this post – and also is available for personal consultation if needed.